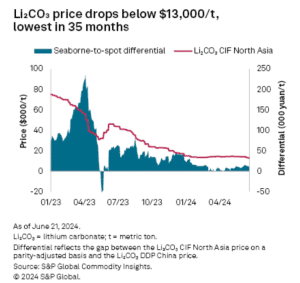

Lithium costs plunged beneath $13,000/ton in June 2024, the bottom in 35 months, in line with S&P World Commodity Insights information. That is regardless of plug-in electrical automobile (PEV) gross sales throughout main markets have surged for the primary 5 months.

Lithium Costs Hit New Lows

Lithium is the important thing factor in manufacturing electrical autos. Although lithium prices noticed a slight enhance in March, they declined in June 2024, pushed by anticipated reductions in downstream battery manufacturing. The seaborne lithium carbonate CIF Asia value fell to a 35-month low of $12,900 per ton by June 18.

Supply: S&P World

Equally, spodumene costs dropped by 9.5% to $1,050 per pound FOB-Australia, inflicting the service provider conversion margin to show adverse, averaging minus $118 per ton in June from $7,027 per ton in Could.

Additional decreases in spodumene costs are wanted to immediate new mine-side provide cuts, final seen when costs fell beneath $900 per ton between mid-January and end-February.

Regardless of low costs, authorities curiosity in securing lithium manufacturing stays sturdy. Indonesia is rising as a big participant in lithium chemical substances manufacturing, integrating uncooked material-to-PEV provide chains. Chengxin began trial lithium chemical manufacturing in Indonesia in June, following the cargo of the primary spodumene cargo from Port Hedland to Indonesia in Could.

Moreover, the Serbian authorities is contemplating greenlighting the Jadar lithium project by Rio Tintowhich was beforehand halted in January 2022. This undertaking could be Europe’s largest built-in lithium mine-to-refinery operation. It has a capability of 58,000 metric tons of lithium carbonate, serving to meet the EU’s battery metals demand.

And it’s not the EU, the remainder of the world is vying for lithium as the worldwide economic system is ramping up electrification in transport.

Authorities Initiatives and World Lithium Demand

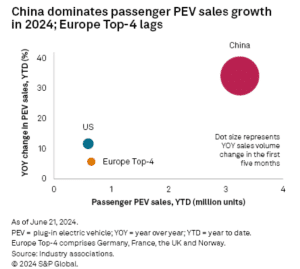

In Could 2024, PEV gross sales throughout key markets elevated by 14.7% month-over-month and 25.9% year-over-year for the primary 5 months, per S&P World report.

China dominated, contributing practically 90% of this progress, buoyed by new mannequin launches and value reductions. Conversely, Germany and Norway noticed declining gross sales, negatively impacting Europe’s prime markets.

Supply: S&P World

In Europe and the US, PEV adoption is stalling because of the greater prices of battery electrical autos (BEVs) regardless of model reductions. Germany’s BEV gross sales dropped by 15.9% year-over-year after the environmental bonus resulted in December 2023. BEV gross sales within the UK comprised 16% of complete automotive gross sales however missed the 22% goal underneath the 2024 zero-emissions automobile mandate.

Within the US, PEV gross sales have remained at 8%-10% of car gross sales in 2024, in keeping with late 2023 ranges. Extra inexpensive fashions, particularly within the $20,000 vary, are wanted to spice up uptake in these markets.

From July 4, the EU will impose tariffs on imported BEVs from China, rising as much as 48.1% from the present 10%. The bloc goals to guard the European automotive business and encourage native BEV manufacturing. Nevertheless, this transfer may hinder the EV transition.

Between 2020 and 2023, BEV imports from China to the EU rose sevenfold. They’ve reached over 437,800 models in 2023, representing 28% of the 1.5 million BEVs offered within the bloc. These imports contained important quantities of lithium carbonate equal (21,300 metric tons).

Accordingly, the EV revolution hinges on how the lithium market is transferring ahead and its forecasts.

Future Outlook for Lithium Market

Lithium costs haven’t proven indicators of sustained restoration as the primary half of 2024 ends. China’s reserve-buying of cobalt metallic in Could offered solely short-lived assist. Costs reached new multi-year lows in June attributable to summer time’s downturn in battery demand and rising provide.

So, what’s in retailer for lithium within the coming months and years?

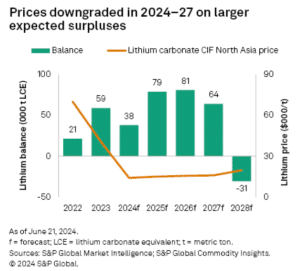

In keeping with S&P World lithium market outlook, extended low lithium carbonate costs are more likely to strain spodumene costs, doubtlessly resulting in additional mine provide cuts and undertaking delays.

Regardless of sturdy copper prices supporting cobalt by manufacturing and rising mine-side stock, diminished client demand for PEVs has prompted many producers to gradual their EV targets and cancel new battery crops, like BMW’s €2 billion contract with Northvolt AB.

Increased import tariffs on China-made BEVs may gradual EV transition within the EU and the US by making autos costlier. The result of EU-China commerce negotiations is essential, as Europe balances relations with China and the US. The latter’s tax credit and funding attracting investments away from Europe, which continues to be constructing its assist system.

Market surpluses for lithium could be bigger in 2024, with forecasts of 38,000 metric tons LCE. Consequently, the lithium carbonate CIF Asia value forecast has been downgraded by $290/t to $14,129/t.

Supply: S&P World

A seasonal restoration in PEV gross sales is anticipated from September by means of year-end, which may slender market surpluses and assist costs. The long-term outlook for PEV uptake stays optimistic as automakers launch extra inexpensive autos within the $20,000 vary.

The way forward for the lithium market stays unsure, with potential for additional provide cuts and undertaking delays. Nevertheless, the long-term outlook for PEV uptake stays optimistic as automakers launch extra inexpensive autos, doubtlessly narrowing market surpluses and supporting costs.