The World Financial institution authorized $1.5B to spice up India’s low-carbon power. This operation goals to spark India’s inexperienced hydrogen market, develop renewable power, and drive funding for low-carbon initiatives. The funding, introduced on June 29 represents the second section of the Low-Carbon Vitality Programmatic Improvement Coverage Operation.

Remodeling India’s Renewable Vitality Market with a US$1.5B Funding Plan

India, the fastest-growing huge economic system globally, is ready to keep up its speedy growth. To decouple this progress from emissions, scaling up renewable power, significantly in hard-to-abate industrial sectors, is crucial. This technique goals to ramp up green hydrogen production and consumption, alongside accelerating local weather finance to assist low-carbon investments. Elaborating additional, the second section of US$1.5B is supposed to rework India’s RE market by:

- Producing ~ 450,000 MT of inexperienced hydrogen and 1,500 MW of electrolyzers yearly from the monetary 12 months 2025-2026. It’ll cowl the prices of the newest know-how required for inexperienced hydrogen manufacturing.

- Boosting renewable power capability by incentivizing battery power storage options Moreover, it promotes renewable power integration via incentives for battery power storage and amendments to the Indian Electrical energy Grid Code. That is poised to cut back emissions by 50MTS yearly.

- Advancing the event of a national carbon credit market.

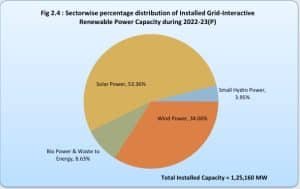

supply: Vitality Statistics India 2024

Auguste Tano Kouame, World Financial institution Nation Director for India famous,

“The World Bank is pleased to continue supporting India’s low-carbon development strategy which will help achieve the country’s net-zero target while creating clean energy jobs in the private sector. Indeed, both the first and second operations have a strong focus on boosting private investment in green hydrogen and renewable energy.”

First Low-Carbon Vitality Program Achievements

Final 12 months (2023) in June, the World Financial institution authorized the $1.5 B First Low-Carbon Vitality Programmatic Improvement Coverage Operation. In response to the World Financial institution, this initiative facilitated transmission cost waivers for renewable power in inexperienced hydrogen initiatives in India. It additionally outlined a transparent technique to launch 50 GW of renewable power tenders yearly and established a authorized framework for a nationwide carbon credit score market.

Aurélien Kruse, Xiaodong Wang, and Surbhi Goyal, Group Leaders for the operation, collectively mentioned,

“The operation is helping in scaling up investments in green hydrogen and in renewable energy infrastructure. This will contribute towards India’s journey for achieving its Nationally Determined Contributions targets.”

The executives additionally praised India’s efforts to ascertain a sturdy home marketplace for inexperienced hydrogen, supported by a fast-growing renewable power capability. They famous that the primary tenders beneath the Nationwide Inexperienced Hydrogen Mission’s incentive scheme have attracted important personal sector curiosity.

India’s Renewable Vitality Panorama via IEA Lens

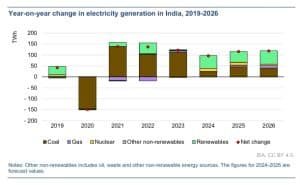

IEA’s 2024 launch talks in regards to the connection between India’s economic system and renewable power demand. India’s GDP grew by 7.8% in 2023, making it the world’s fastest-growing main economic system and the fifth largest globally. Vitality demand in India is anticipated to outpace all areas by 2050 as a result of urbanization and elevated demand for electrical energy, cement, and metal. This reliance on imported fossil fuels may improve carbon emissions considerably. Therefore, an urgency to curb emissions and turn into web zero by 2070.

India has scaled up photo voltaic and wind investments and promoted home clear power manufacturing via the Manufacturing Linked Incentives scheme. The nation additionally boasts of robust power effectivity packages and a brand new hydrogen coverage.

India has scaled up photo voltaic and wind investments and promoted home clear power manufacturing via the Manufacturing Linked Incentives scheme. The nation additionally boasts of robust power effectivity packages and a brand new hydrogen coverage.

Newest media reviews say that India entered the sovereign inexperienced bond market in January 2023, issuing bonds value $1B. This has spurred clear power investments, reaching $68B in 2023. Fossil gas funding additionally rose to $33 billion. To satisfy the power and local weather targets, India must double clear power funding by 2030. Nonetheless, this might suffice with an additional 20% increase. Decreasing capital prices is vital to creating this occur.

As of March 2024India’s thermal energy accounts for 56% of put in capability, whereas renewable power sources contribute 32%, hydroelectric energy 11%, and nuclear energy 2%. The World Financial institution has supported this transition with this big mortgage.

- India’s objective is to construct 47 GW/236 GWh of battery storage and produce 5 MMT of fresh hydrogen by 2030.

- India additionally plans to attain 40 GW of electrolyzer manufacturing capability, 30 MMT of carbon seize, and a couple of MMT of sustainable aviation fuels by 2030.

General, the World Bank funding can speed up India’s dedication to surpassing 500 GW of renewable power capability by 2030. Additional aiming to steer in superior power options. With power giants like Tata, Adani, and Reliance, the nation is near attaining its power transition targets.