Shell Nederland Raffinaderij B.V., a subsidiary of Shell, is pausing building at its huge biofuel facility in Rotterdam. The 820,000tpa capability web site at Shell Vitality and Chemical substances Park will halt work quickly to deal with different very important points of the corporate. So, what’s the actual cause behind Shell’s huge resolution? Will this influence its operations, world market worth, and staff by giant? Learn and uncover extra…

Why did Shell take this Daring Resolution?

Explaining straightway, Wael Sawan, CEO of Shell needs to prioritize the corporate’s most worthwhile ventures, notably in oil and fuel. This strategy has resulted within the firm pulling out of much less worthwhile renewable and hydrogen projects. The end result of this resolution is the non permanent halt of the Rotterdam biofuels undertaking. Shell can be conducting an intensive valuation overview of this unit. The 820,000t unit was additionally set to supply sustainable aviation gas (SAF), other than renewable diesel. In line with media reviews, they aimed to begin operations in 2025, however now it has been postponed to the top of the last decade.

One other key cause for ceasing the unit is to decelerate actions and scale back contractor energy for higher price management. They consider this can assist optimize and streamline undertaking sequencing. With this new modification, Shell goals to reevaluate undertaking supply and keep competitiveness within the present financial state of affairs.

Huibert Vigevano, Shell’s downstream head confirmed that,

“Temporarily pausing on-site construction now will allow us to assess the most commercial way forward for the project. We are committed to our target of achieving net-zero emissions by 2050, with low-carbon fuels as a key part of Shell’s strategy.”

UBS analyst Joshua Stone remarked,

“The pause was consistent with Shell’s strategy to focus on returns. The delays further highlight that the advanced biofuels market is not an easy one. The oil majors have dipped their toes and found it challenging.”

Shell Canada Greenlights Main Carbon Emission Lower

As this information got here as a shock to many, there’s a silver lining for our information readers. In the meantime, Shell Canada lately achieved the ultimate funding resolution (FID) for CCS tasks, together with the Polaris undertaking and the Atlas Carbon Storage Hub, in partnership with ATCO EnPower. The media launch notes that Polaris (100% Shell-owned) can scale back Scope 1 CO2 emissions at Shell’s Scotford refinery by capturing and storing as much as 40% and by as much as 22% on the chemical compounds advanced. The operations are slated to start by the top of 2028.

Transferring on, Shell Japanese Buying and selling has acquired Pavilion Vitality from Carne Investments, gaining 100% management. That is one other vital milestone that occurred final month. Pavilion Vitality, primarily based in Singapore, operates a world LNG buying and selling enterprise with 6.5 mtpa of contracted provide, alongside delivery, and fuel provide actions in Asia and Europe. This acquisition manifests Shell’s LNG portfolio. It additionally offers strategic entry to key markets, rising flexibility to satisfy power safety wants in Asia and Europe.

Although it may appear uncanny for firms to halt tasks in progress, Shell isn’t the primary firm to announce it. Vitality large BP lately introduced a pause on two biofuel tasks in Germany and the U.S.

Media businesses just like the Monetary Instances have reported that Biofuel costs have been beneath downward stress lately. That is due to diminished demand in Europe following Sweden’s biofuel mandate lower, alongside elevated provides from the U.S. Nonetheless, Shell shares elevated by 1.3% at 1106 GMT, displaying an increase of over 12.5% this yr.

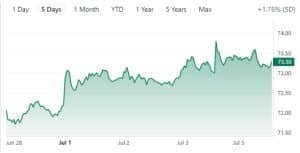

Shell has a market cap or internet value of $235.01 billion. The enterprise worth is $277.77 billion. As of the newest information, Shell’s inventory value within the final 5 days was $73.25 per share, as proven within the picture under.

supply: stockanalysis

NYSE: SHEL · IEX Actual-Time Worth · USD 73.25

How Shell Makes use of Carbon Credit to Form the Future

Shell’s carbon credit play a vital function of their purpose to turn into a net-zero emissions power enterprise. These credit assist Shell and its prospects offset emissions, adhering to the mitigation hierarchy: keep away from, scale back, and compensate. Notably, Shell selects tasks licensed by the Verified Carbon Customary, Gold Customary, and the American Carbon Registry. Within the ESG sphere, the corporate helps generate carbon credit from nature-based tasks and applied sciences. In 2023, Shell’s internet carbon depth (NCI) included 20 m carbon credit, with 4 m linked to power product gross sales.

Shell’s Web-zero emissions by 2050 (Scope 1, 2, and three), reported by Shell’s Energy Transition Strategy, 2024

Emissions from inside operations (Scope 1 and a couple of)

- Halve Scope 1 and a couple of emissions by 2030 (2016 baseline).

- Eradicate routine flaring from Upstream operations by 2025.

- Keep methane emissions depth under 0.2% and obtain near-zero methane emissions by 2030.

Emissions from offered merchandise (Scope 3):

- Scale back the web carbon depth (NCI) of the power merchandise we promote by 9–12% by 2024, 9–13% by 2025, 15–20% by 2030, and 100% by 2050 (2016 baseline).

- Ambition to cut back buyer emissions from using our oil merchandise by 15–20% by 2030 (Scope 3, Class 11) (2021 baseline)

World Market Insights reviews that the European biofuel market dimension exceeded USD 26.5 B in 2023 and is prone to register a 6.7% CAGR from 2024 to 2032, owing to the rising issues about local weather change and demand for sustainable power sources. The European authorities goals to spice up renewable fuels to roughly 14% of transport power by 2030, with substantial demand. With this prediction, we are able to hope the way forward for power giants like Shell is promising, amid the biofuel increase.