Join daily news updates from CleanTechnica on e-mail. Or follow us on Google News!

On this introduction weblog for SACE’s newest version of our “Solar in the Southeast” report sequence, you’ll be able to learn up on which utilities and states can count on to see photo voltaic progress. Further blogs on this sequence will unpack extra of the outcomes, observations, and key coverage developments detailed within the report.

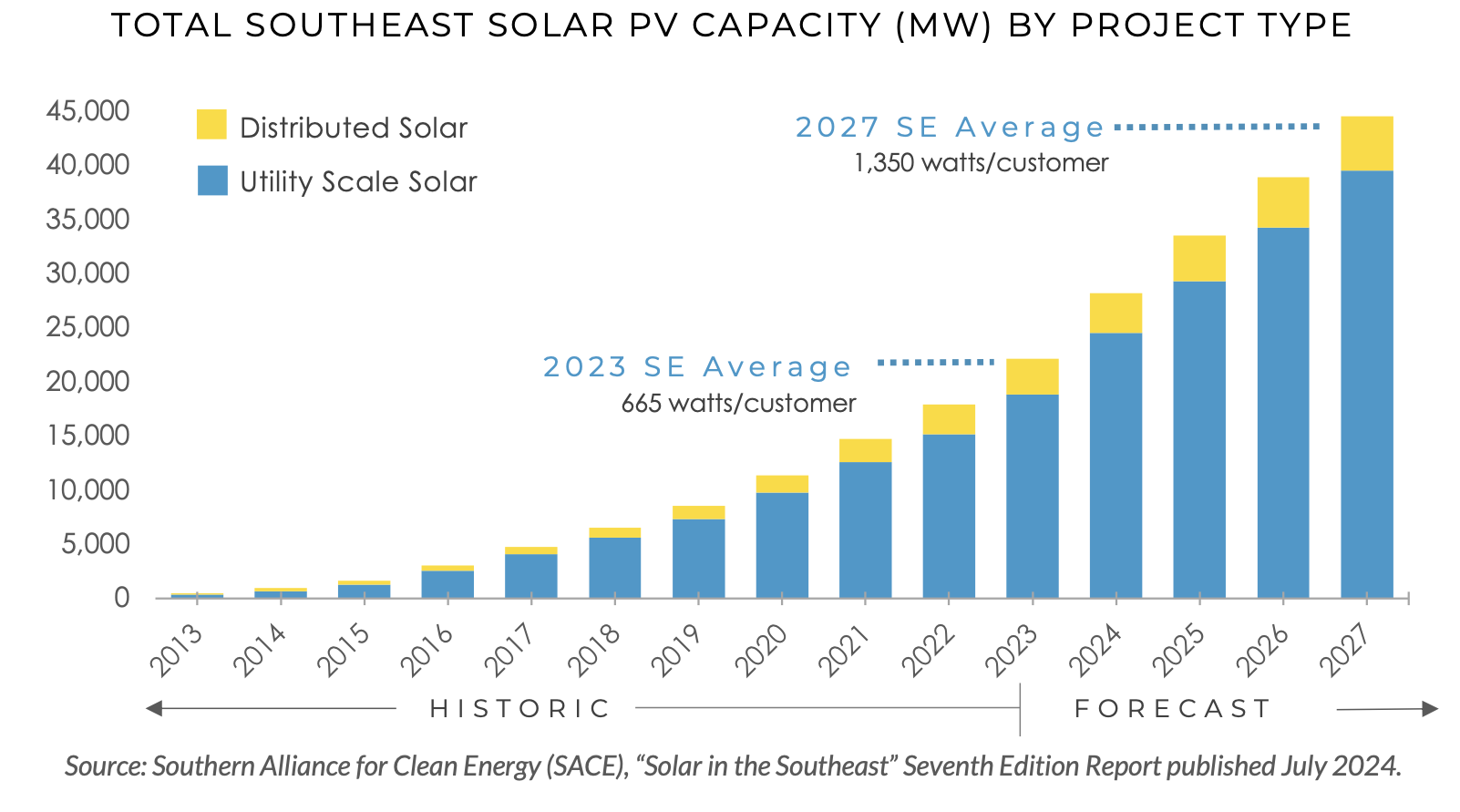

Now that it’s summer time, it’s time to shine a light-weight on photo voltaic progress within the Southeast. In SACE’s newest version of our “Solar in the Southeast” report sequence, you’ll be able to learn up on which utilities and states can count on to see photo voltaic progress. General, the Southeast can now declare about 22 gigawatts (GW) of photo voltaic (22,183 megawatts, MW) on a full-year operational equal foundation, or a mean photo voltaic ratio of 665 watts per buyer in 2023. The Southeast is projected to just about double the quantity of photo voltaic within the area to virtually 44 GW for 2027. We additionally element how key coverage developments akin to latest utility useful resource plans and the inflow of federal funding from the Inflation Discount Act (IRA) to Southeastern states assist inform and develop the photo voltaic market.

REGISTER FOR THE REPORT WEBINAR ON JULY 16

How will we monitor photo voltaic progress for various states and utilities?

We begin by trying on the total quantity of photo voltaic measured in megawatts (MW) of capability which can be working or deliberate in a state or utility. Photo voltaic tasks might be categorized as both utility-scale photo voltaic or distributed photo voltaic. Distributed photo voltaic is smaller and is usually put in on the rooftops of residential or business clients, whereas utility-scale photo voltaic is bigger and is put in in ground-mounted arrays owned by a utility or a developer.

Utility-scale photo voltaic capability figures embrace each tasks which have been reported to federal knowledge collectors, in addition to the mixture capability of future photo voltaic assets in a utility’s built-in useful resource plan (IRP) which have but to be sited at a selected location. In each circumstances, the utilities might buy energy from a photo voltaic developer to obtain the photo voltaic undertaking’s output for a 20–30-year interval as an alternative of proudly owning it outright, however the capability itself remains to be attributed to the utility for that point interval.

Distributed photo voltaic is interconnected to the utility in a wide range of completely different program stylings, akin to net-metered photo voltaic, digital photo voltaic, and tariffed photo voltaic, that are included in all of our figures.

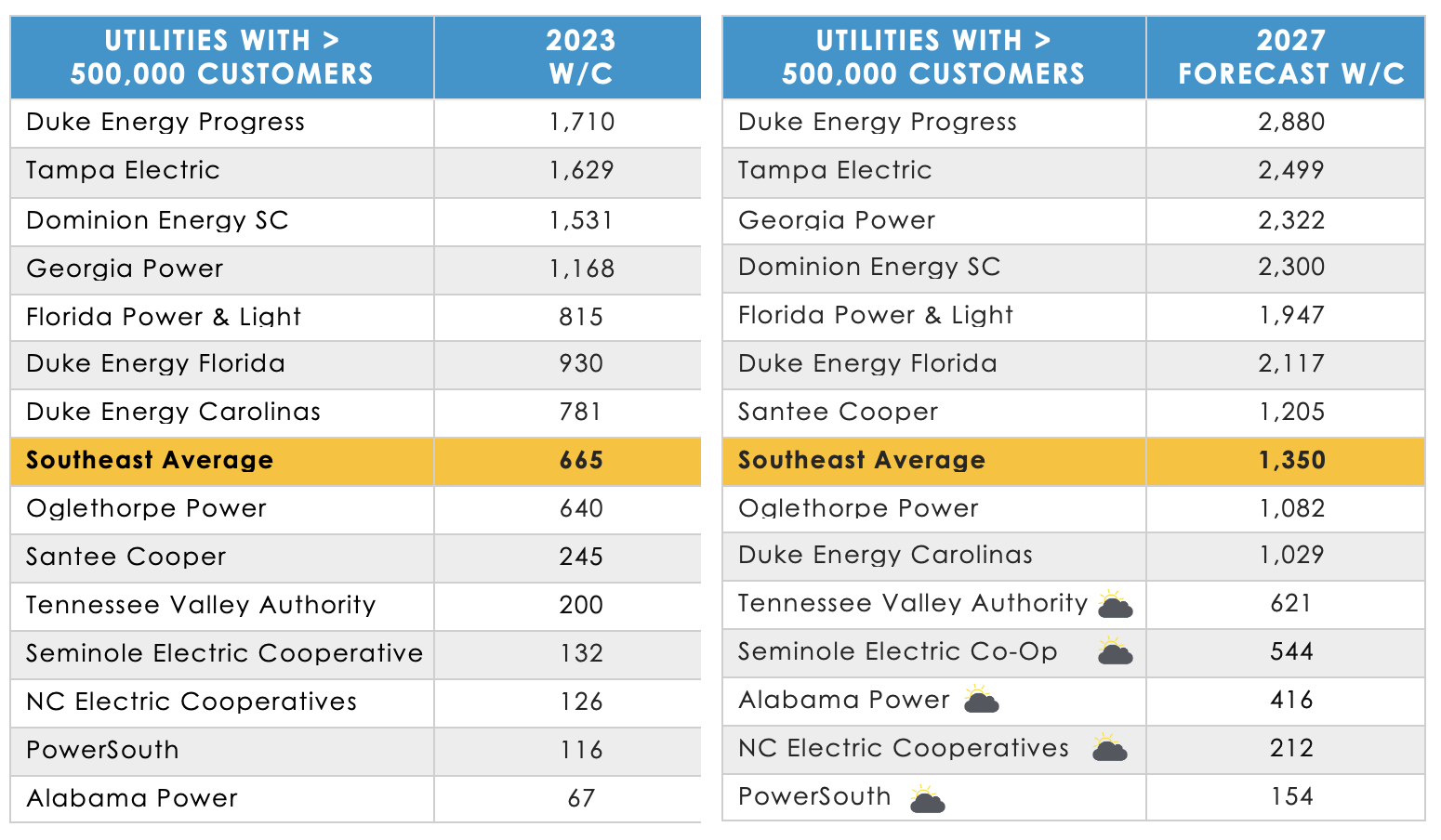

Altogether, the Southeast is ready to declare greater than 22 gigawatts (GW) of photo voltaic (22,183 MW) as of 2023. To be able to examine a whole lot of various utilities within the Southeast, SACE ranks utilities on the premise of photo voltaic watts per buyer (W/C). This illustrates the general quantity of solar energy sourced to a utility or state relative to the variety of that particular utility’s retail clients. To make use of 2023 for example, the Southeast regional common would equate to a mean photo voltaic ratio of 665 watts per buyer for the area’s 33 million clients served by electrical utilities. That measurement is for the whole area, and each utility throughout the area in flip has its personal metric that could be larger or decrease than the regional quantity.

The most recent figures present photo voltaic progress regardless of some unrealized potential

General, the Southeast is projected to just about double the quantity of photo voltaic to virtually 44 GW over the subsequent 4 years, rising to 1,350 watts per buyer in 2027. On the whole, utilities throughout the Southeast have made bigger capability deployments in shorter time frames than ever. For instance, Florida Energy & Mild deployed roughly a gigawatt of photo voltaic capability in 2023. This can be a pattern that may solely proceed to enhance with stronger planning processes for utility assets and transmission.

But, there’s nonetheless some unrealized potential in latest utility useful resource plans and regulatory approvals. For instance, Georgia Energy ranks above the regional common in watts per buyer (W/C) at 1,168 W/C in 2023 regardless of its newest useful resource plan, and never due to it. Georgia Energy unexpectedly filed an up to date IRP in 2023 exterior the common schedule resulting from unanticipated load progress, however as an alternative of including any incremental photo voltaic within the near-term, it has as an alternative pushed for extra fossil fuel. Likewise, regardless that Alabama Energy has obtained approval to construct 2,400 MW of extra renewable power era by 2029, a previous approval of 400 MW went largely unused for many of its timeframe earlier than being prolonged, that means Alabama Energy didn’t find yourself siting a lot of the photo voltaic that was authorised.

There are additionally some utilities which can be presently present process useful resource planning course of, or anticipated to begin quickly: Duke’s utilities within the Carolinas filed an replace to their useful resource plan in January 2024 that sadly doesn’t permit new incremental photo voltaic earlier than 2028; and the Tennessee Valley Authority (TVA) was set to launch its IRP in March, however that has now been delayed to the autumn of 2024. Nonetheless, each of those useful resource plans could be unlikely to be mirrored within the near-term forecast that’s the focus of this report.

This yr’s report displays a number of SunBlockers: utilities whose four-year forecast stays beneath final yr’s regional common. The Tennessee Valley Authority (TVA) sadly fell simply in need of the benchmark wanted to keep away from making the this yr. And regardless of a promising improve from new photo voltaic capability anticipated to offer energy to the grid, Alabama Energy has but to make it off the SunBlocker record. The North Carolina Electrical Cooperatives, Seminole Electrical, and PowerSouth are all on the backside of the record this yr.

Nonetheless, there’s hope for utilities which can be on the SunBlocker record. Many provisions of the Inflation Discount Act (IRA) are geared toward offering certainty to builders and increasing financing choices for non-traditional utilities, akin to direct pay of the ITC (Funding Tax Credit score) and PTC (Manufacturing Tax Credit score) in addition to the New ERA (Empowering Rural America) funding. So utility useful resource plans and different photo voltaic professional,rams supplied by states or utilities nonetheless have unrealized potential they need to think about cashing in on.

In subsequent blogs we we are going to unpack the utility rankings and watts per buyer forecast for main utility programs additional. Moreover, we are going to discover the SunRisers from this yr’s report, the utilities exhibiting the very best complete improve in W/C photo voltaic ratio between the baseline yr (2023) and the four-year forecast (2027). Keep tuned for extra!

Courtesy of Heather Pohnan and Bryan Jacob, Southern Alliance for Clean Energy

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy