The choice by the Texas State Board of Training to terminate its funding partnership with BlackRock has reignited the talk surrounding Environmental, Social, and Governance (ESG) investing in america. With $8.5 billion withdrawn from the funding big, the transfer underscores the deepening divide between political and funding methods.

On the heart of this controversy is BlackRock, the world’s largest asset supervisor and a vocal advocate for ESG principles.

Whereas BlackRock’s management in selling sustainability and local weather motion has garnered reward from many traders and stakeholders, it has additionally drawn sharp criticism from some Republican politicians in states like Texas. These politicians accuse BlackRock of advancing a left-wing agenda and undermining conventional vitality sectors.

The Rise of ESG Investing

ESG investing, brief for Environmental, Social, and Governance investing, evaluates firms based mostly on their efficiency throughout numerous duty metrics and requirements to evaluate their suitability for funding.

By utilizing these requirements, traders can determine companies that present sturdy environmental stewardship, social affect, and efficient governance practices. ESG investing can be known as sustainable investing, affect investing, and socially accountable investing.

Many ESG traders put a better worth on the environmental issue and take away environmental polluters from their portfolios. They as an alternative determine to spend money on firms that choose to scale back dependence on fossil fuels.

The state of Texas has been a battleground within the anti-ESG motion. State officers are taking decisive actions towards firms and traders perceived to be prioritizing social and environmental considerations over financial pursuits.

For example, Texas lately banned UK financial institution Barclays from collaborating within the municipal bond market because of its ESG insurance policies. The state has additionally thought of divesting from asset managers accused of boycotting vitality firms.

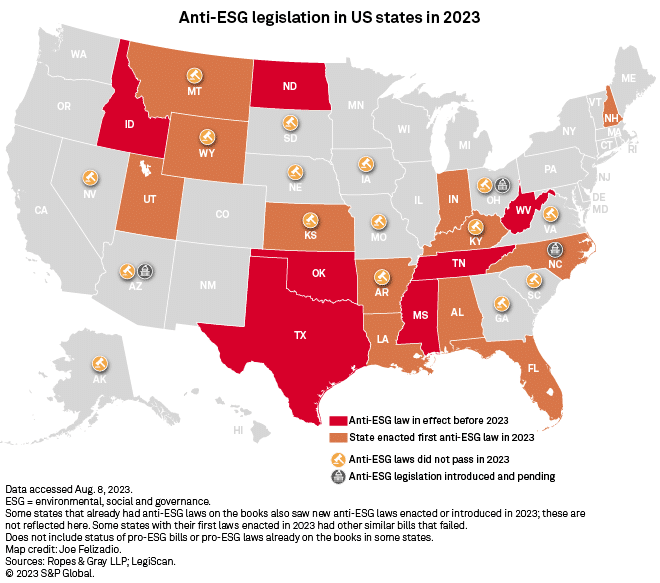

Texas isn’t alone in rallying towards ESG investing. In 2023, states with Republican-controlled legislatures noticed the enactment of at the very least 25 anti-ESG payments.

Utah, specifically, handed 5 of those payments, contributing considerably to the general depend. Regardless of these legislative successes, a couple of payments are nonetheless pending approval. These developments had been reported on a web site maintained by Lichtenstein’s crew, devoted to monitoring such payments.

Texas’s anti-ESG stance could attraction to some constituents. Nonetheless, it might come at a big price to traders and the state’s economic system.

A examine performed by the Texas County & District Retirement System estimated potential losses of over $6 billion in ten years from prohibiting ESG investing in public retirement techniques. This underscores the advanced trade-offs concerned in balancing monetary returns with social and environmental goals.

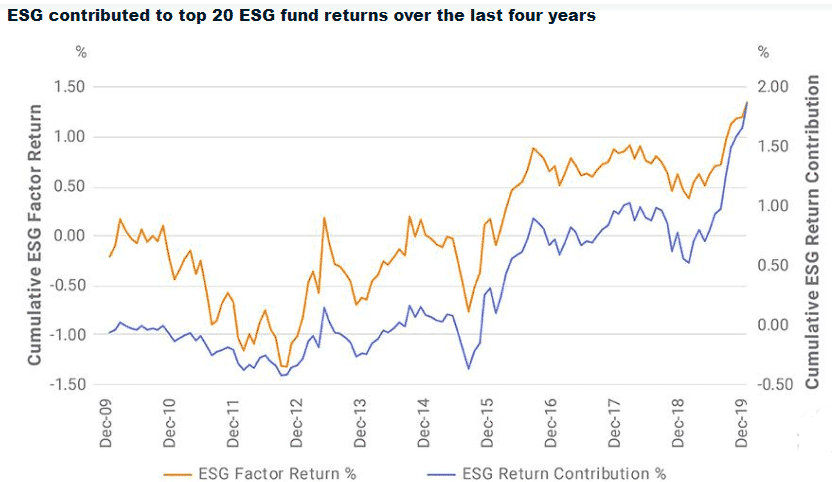

Furthermore, MSCI’s report confirmed that the highest 20 ESG funds noticed rising return contributions due to higher ESG efficiency.

Texas Takes a Stand

In defending its resolution to terminate the partnership with BlackRock, the Texas State Board of Training cited laws prohibiting funding in firms that boycott sure vitality corporations.

Board Chairman Aaron Kinsey expressed concern about BlackRock’s affect on Texas’s oil and gasoline business. The Texas Permanent School Fund (PSF) will get its cash from the business’s income.

In a press release posted on X, Aaron Kinsey, PSF Chair, famous that:

“BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil and gas economy and the very companies that generate revenues for our PSF… The PSF will not stand idle as our financial future is attacked by Wall Street.”

The assertion displays rising considerations amongst sure stakeholders in Texas relating to the affect of ESG issues on funding selections. And that it might even have potential impacts on the state’s vitality sector. In keeping with the state BOE’s web site, Kinsey is the CEO of American Patrols, an aviation oilfield companies firm in Midland.

Critics argue that this may occasionally undermine the long-term monetary well being of PSF and restrict its capacity to attain funding goals.

BlackRock Defends its Place

BlackRock has confronted mounting scrutiny from Republican politicians and activists who accuse the corporate of selling a leftist agenda. Final yr, the asset supervisor inked a deal to speculate $550 million in Occidental Petroleum’s Direct Air Seize (DAC) plant in Ector County, Texas.

In response to the state’s resolution, BlackRock’s CEO Larry Fink has defended the corporate’s engagement with the vitality business. He acknowledged in an e-mail that:

“The decision ignores our $120 billion investment in Texas public energy companies and defies expert advice. As a fiduciary, politics should never outweigh performance, especially for taxpayers.”

Regardless of these criticisms, BlackRock emphasised its vital investments in U.S. vitality firms. Furthermore, the corporate famous that it’s instrumental in aiding thousands and thousands of Texans in investing and saving for retirement. They’ve additionally channeled over $300 billion into Texas-based firms, infrastructure, and municipalities, with a good portion, totaling $125 billion, directed towards the vitality sector.

Final week, the funding big revealed a report figuring out key developments that may affect low-carbon transition funding alternatives and dangers in 2024.

As the talk over ESG investing continues to evolve, traders and policymakers should rigorously weigh the potential advantages and downsides of incorporating environmental, social, and governance issues into funding selections.