With the worldwide vitality transition looming giant, many have been setting their sights on supplies vital to the vitality transition, comparable to copper, lithium, or uranium.

Nickel is yet one more mineral on that checklist, albeit one which appears to have largely flown underneath most traders’ radars to date.

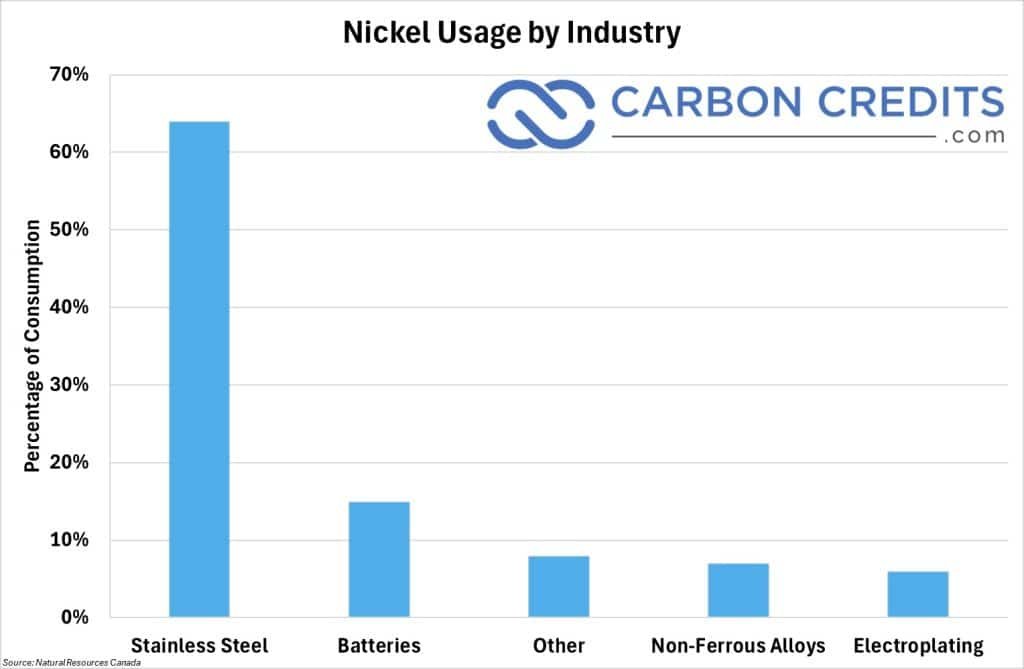

It’s comprehensible why that’s been the case – in spite of everything, the first use for mined nickel has lengthy been industrial, with over three-quarters of worldwide nickel demand being for issues like alloy manufacturing or electroplating.

Nonetheless, there’s one avenue of “green” demand for nickel that’s been slowly but steadily driving up consumption – and that’s electric vehicle (EV) batteries.

- Final yr, the common battery EV bought contained 25.3 kilograms of nickel – and that quantity has been going up yr over yr

Nickel is without doubt one of the key elements of the lithium-ion batteries that energy EVs worldwide, because of its distinctive bodily and chemical properties.

So as to be utilized in an electrical car, nickel should first be refined to extraordinarily excessive purities, creating what’s generally known as “battery grade” nickel. Following this, it then must be dissolved in sulphuric acid to create nickel sulphate, which may then be used to provide battery cathodes.

Nickel’s excessive vitality density, which permits it to carry extra cost for much less weight, makes high-nickel battery chemistries extra fascinating in EV batteries. Whereas the primary iterations of the lithium-ion battery used equal proportions of nickel with manganese and cobalt, fashionable ones use as a lot nickel as manganese and cobalt mixed.

And as expertise continues to progress, it’s anticipated that the ratio will rise to as a lot as 80% nickel, or much more.

That’s why nickel is now on the vital minerals checklist of a number of nations together with the US, the EU, and Japan.

The Lights Are Inexperienced for Nickel.

EV producers are including increasingly nickel to their batteries annually so as to enhance the effectivity and vary of their automobiles.

- EVs bought in 2023 contained 8% extra nickel, on common, than these bought a yr earlier

Mix that with the truth that EV gross sales are anticipated to proceed rising at a breakneck tempo, and what you find yourself with could be very wholesome outlook for long-term nickel demand.

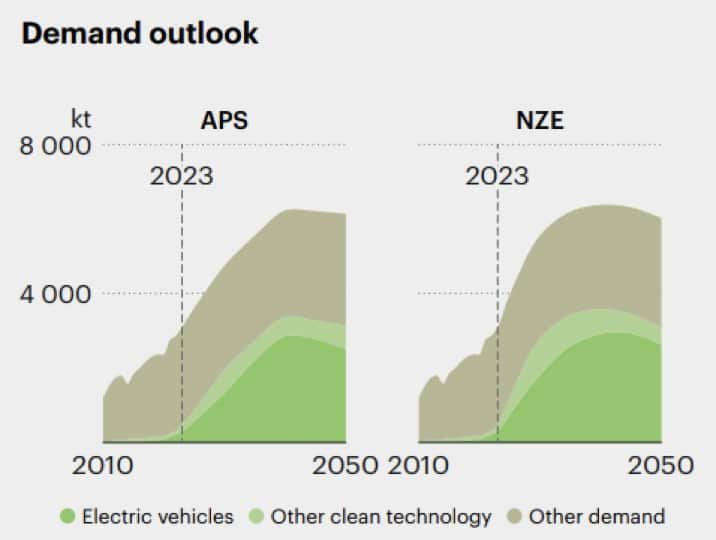

Beneath you may see two charts created by the Worldwide Power Company. The one on the left forecasts nickel demand progress out to 2050 primarily based on at present present local weather pledges, whereas the one on the fitting reveals the identical however in a extra aggressive internet zero situation:

You’ll be able to see that, no matter which situation we contemplate, nickel demand is predicted to greater than double over the subsequent decade – the one query is how briskly we get there.

Even within the conservative case the place no extra local weather pledges are made within the coming years, as within the chart on the left, EV and cleantech demand for nickel remains to be anticipated to massively drive nickel’s demand progress.

- Final yr, whole nickel demand amounted to three.1 million tonnes, of which 478,000 got here from EVs and cleantech. This latter portion is predicted to develop to 2 million tonnes of nickel demand by 2030 and three.4 million tonnes by 2040 within the base case – and it might simply be extra, if governments around the globe pursue further local weather targets

Whereas all eventualities do see nickel consumption plateauing and falling off barely in the direction of the tail finish of 2050 resulting from forecast decrease demand for nickel-rich battery chemistries, there’s nonetheless a 9x enhance in nickel demand for EV batteries and different cleantech even within the conservative case.

Merely put, the long run for nickel seems large.

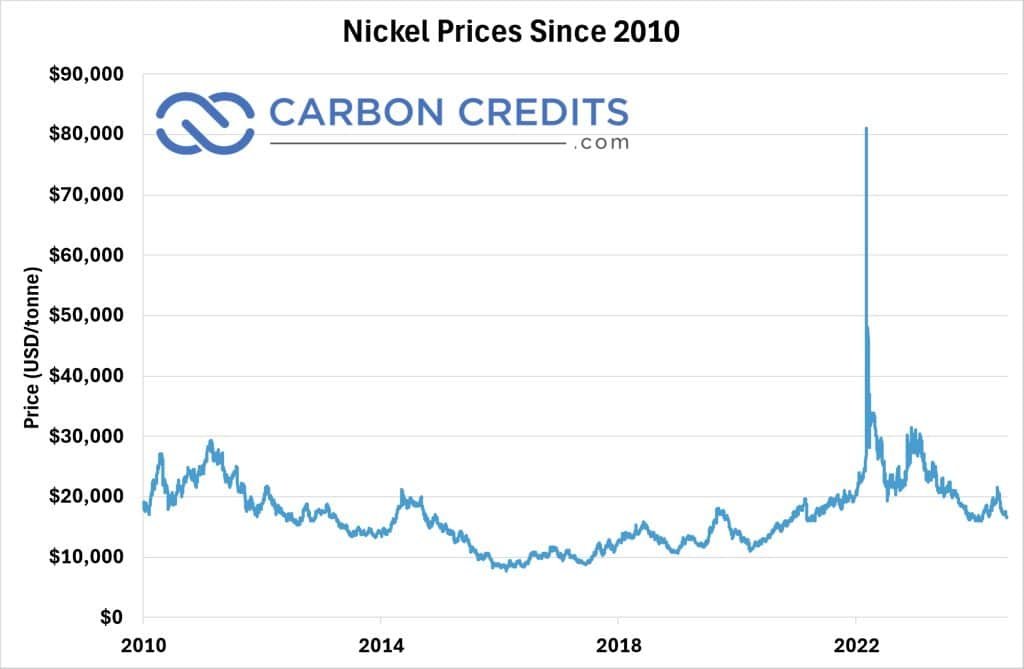

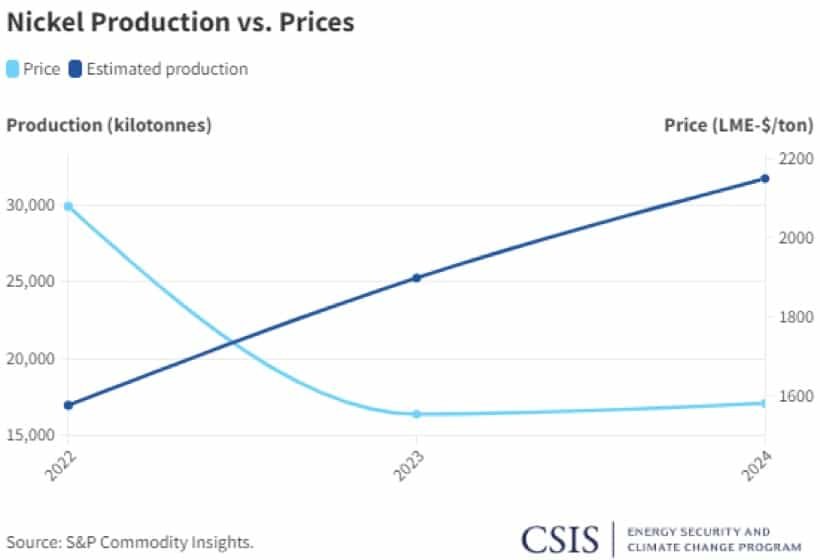

Nonetheless, the latest worth efficiency of nickel appears to inform a special story:

And that’s due to the opposite half of the image: nickel provide.

However There’s a Provide Jam . . .

Regardless of how robust the demand outlook for nickel seems, there’s no escaping the truth that proper now, provide far outstrips demand.

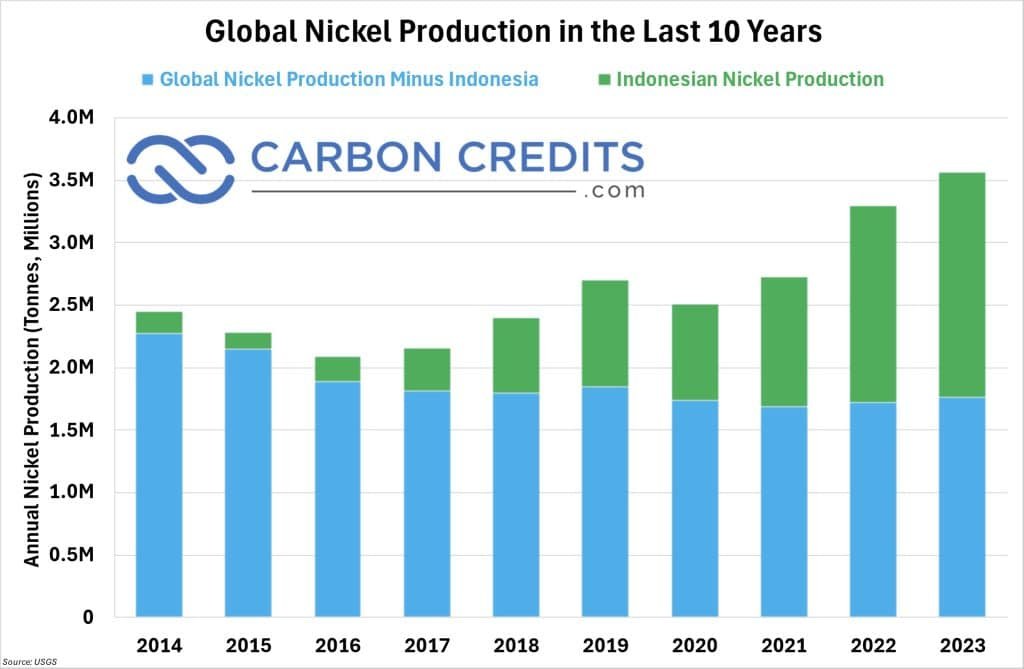

And there’s precisely one issue we are able to level to for this: Indonesia.

Prior to now ten years, Indonesia has accelerated the tempo of nickel mine growth domestically, because of heavy Chinese language funding.

- In 2014, Indonesia produced simply 7% of the world’s nickel, with simply two nickel smelters. 10 years later in 2023, Indonesia now accounts for simply over 50% of worldwide manufacturing, with 43 operational smelters and one other 52 on the best way

Indonesia obtained $7.3 billion in international funding from China’s Belt and Highway Initiative in 2023, the biggest of any collaborating nation. 90% of the nickel smelters in Indonesia have been constructed by Chinese language firms, and many of the mines are Chinese language owned as nicely.

Due to the in depth Chinese language involvement, the decrease labor prices and environmental requirements for nickel mines in Indonesia have additionally led to decrease manufacturing prices. Nickel from Indonesian mines is cheaper to provide than it’s on different nations like Australia or Canada.

This breakneck progress of Indonesian manufacturing, throughout a weak worth setting the place different producers have scaled again, has contributed to Indonesia’s rise to prominence as the highest world nickel producer.

It’s anticipated that the nickel market will see a surplus of 36,000 tonnes this yr, in response to a latest report from Macquarie. And it’s unlikely that the nickel market will steadiness out till after 2025.

Additional Down the Highway, the Outlook Seems Rosy

Regardless of how the availability and demand steadiness seems proper now, nonetheless, it’s not anticipated to remain that approach as we close to the top of the last decade.

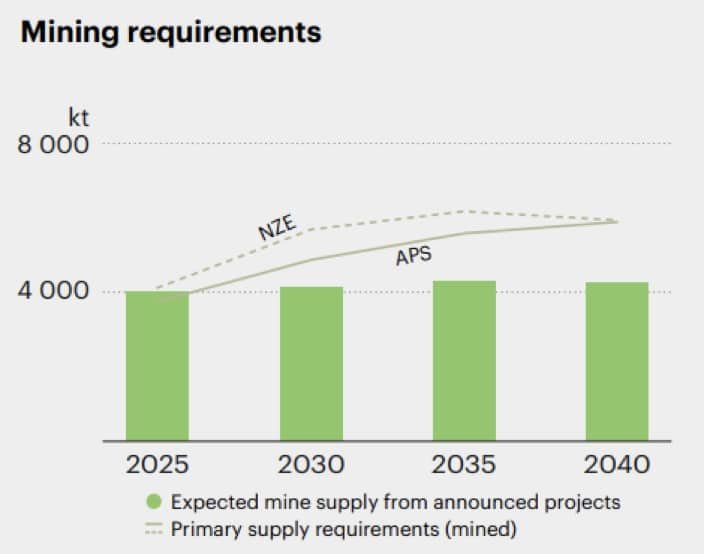

Because the chart above reveals, primarily based on present introduced mine provide, the nickel market is predicted to enter a provide deficit shortly after 2025 – and this shortfall is predicted to widen significantly within the decade following, even within the conservative situation (the stable line).

In different phrases, regardless that the present low nickel worth setting is discouraging funding, it’ll additionally create extra alternatives down the highway because of the eventual supply-demand hole that may widen because of the present lack of curiosity in nickel mining.

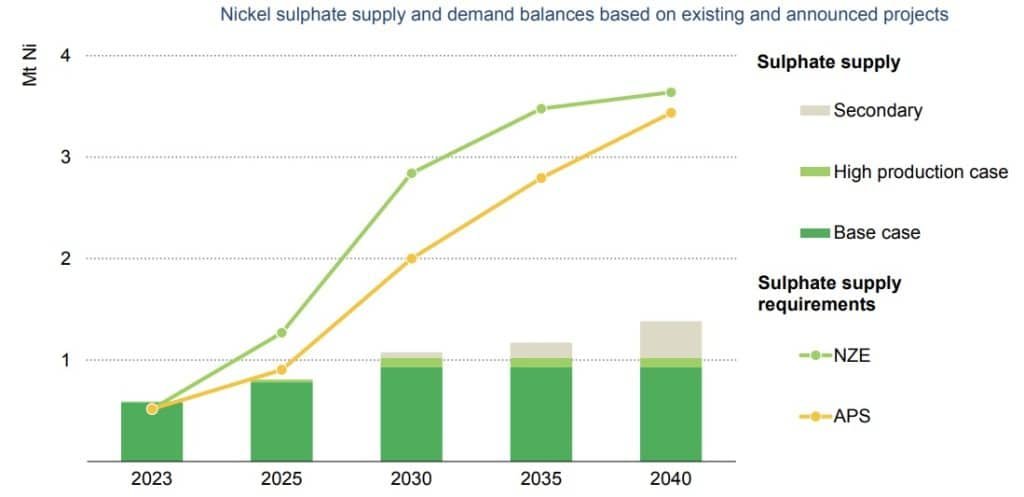

Moreover, as you may recall, so as to be utilized in EV batteries nickel must be additional processed into nickel sulphate, which is one thing not all uncooked nickel refineries are constructed to do.

The provision shortfall for nickel sulphate is predicted to see a fair wider hole than for mined nickel. That stated, processing services for nickel sulphate could be constructed on the order of 18-24 months – a lot faster than a mine, which is commonly a years-long course of that may get slowed down in research and allowing.

Even so, the sheer quantity of further nickel sulphate provide required represents yet one more alternative within the nickel markets.

Within the close to time period, it’s probably that nickel prices will proceed to remain weak as provide continues to outpace demand. As we close to the top of the last decade and the push in the direction of internet zero continues to speed up, nonetheless, the projected supply-demand hole may simply depart the nickel market in considerably totally different form than the way it seems now.